This past Sunday (23rd March), I attended my third IndiBlogger Meet in Bangalore. Only this time, this was the first IndiBlogger meet to be simultaneously held in Mumbai and Delhi as well. What was the special occasion? Kotak Mahindra Bank was using this simulcast meet to launch Jifi, a new social banking service. A first of its kind if you may — but more on Jifi later.

The IndiBlogger meet in Bangalore was held at The Biere Club, on Vittal Mallya Road.

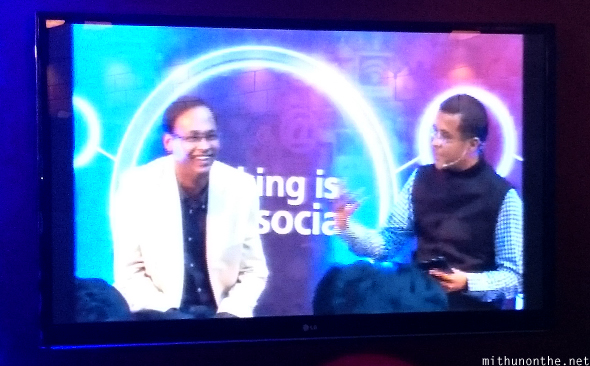

Then we had a surprise guest, who was brought in by Kotak Mahindra Bank to debut Jifi. Who was it? A celebrity? A popular actor? Well, they asked us to guess and the only clue we were given was that he was a “nerd”.

I immediately guessed Chetan Bhagat! Seemed like the only obvious choice to endorse a bank.

And lo and behold…

Chetan Bhagat then began talking about how the times have changed and how banking should too. This was segued into the video introduction of Jifi. (You can view the promos here)

Overall the IndiBlogger meet was well-organized, the food served was great, drinks were on the house and a great time was had — all thanks to the fine folks at Kotak Mahindra Bank who hosted the event!

Now, about Jifi. Let’s get the basics out of the way. Jifi comes off as a bank account you can open using either your Facebook/Twitter login or e-mail ID — but it’s not exactly a proper bank account. Once you have signed up for a Jifi account, you earn some social points just for registering using Facebook/Twitter. You earn more social points by sending invites to your Facebook friends and asking them to sign up for a Jifi account as well. These points can be then redeemed on a one-to-one cash ratio (I specifically asked about this) on many online vendors such as eBay.in! For example, if you earn 1000 points, it’s as good as having Rs. 1000 in your account to make online purchases (like you would using a voucher). Making transactions such as cash deposits let you earn transaction points as well. All these points are part of Jifi’s Loyalty Club membership.

Other simple ways to collect points is by Liking and commenting on posts appearing on the Kotak Jifi and Kotak Bank Facebook pages. Simple enough, right? There’s a host of other social media features too, like requesting a cheque book using your Twitter handle, checking your account balance or even asking for where the nearest Kotak Mahindra ATM just by Tweeting.

But at this point you must be thinking: “Wait, if I make a transaction online… is that something that will be shared as a status update on Twitter or Facebook?”. No. In fact no one can see your transaction details on Twitter or Facebook. Jifi/Kotak Mahindra will only send you the requested details via a DM (direct message) on your personalised Twitter handle.

The biggest concern for all at the Indiblogger meet was security. Considering how prone our Twitter and Facebook profiles are to hackers, linking those credentials to a banking account is sometimes a scary thought. But like I said, Jifi isn’t the bank account. It’s just a social media layer. For actual banking transactions like funds transfer, bill payments, savings remittances, etc. a Jifi user will still require a Kotak Mahindra account — which they can easily sign up and one that comes with different login credentials — and not your social media/Jifi login.

Even after opening a proper Kotak Mahindra bank account, your Jifi profile gets linked to it so that the account holder earns points for making various transactions. If your Jifi account gets hacked, don’t panic. All the user has to do is login to kotakjifi.com, go to social banking section and de-register your social media account.

One of the biggest marketing highlights was that Jifi requires no minimum balance. Yes, that’s because, like I said — Jifi isn’t the proper bank account. The proper (linked) Kotak Mahindra bank account still requires a minimum balance of Rs. 5000.

You also get a ‘free’ chip-based Platinum Debit Card — but for that, there exists some “fine print” too. I can’t list out each and every feature of Jifi… because I’m still learning more about the service as I use it. For all the “fine print,” please refer to the FAQs on this page. Jifi is being updated into the Kotak Mahindra mobile app and you can read more about Jifi’s features on the official website.

All said and done, I honestly think Jifi is a clever initiative by a bank. The social media integration and a points reward system for even simple things like liking or commenting on Kotak Mahindra’s Facebook page is a very clever way of engaging a young consumer just getting into banking. It’s also a very clever way of getting, say a college kid or the ‘first job’ youth to sign up for a bank account with Kotak Mahindra Bank. As I said, Jifi isn’t the bank account — but eventually you will get to a stage where you wish to earn more points by doing some real banking transactions. That’s when you will move on to the next step to sign up for a Kotak Mahindra bank account.

In a staid and dull world of Indian banking, Jifi actually came off as refreshing and exciting. So hats off to Kotak Mahindra Bank for actually conceiving such an idea. How well it does, only time will tell. Until then, give it try — signing up is easy-peasy.

Nitya Pillay

20/11/2015Kotak Bank’s Jifi is its best offering and I am truly in love with it. It also caters to minors’ needs who otherwise cannot open a proper savings account. Kotak ll the way…